Strategy

A Cerebro instance is the pumping heart and controlling brain of backtrader. A Strategy is the same for the platform user.

Cerebro 만큼 Strategy 도 중요하다

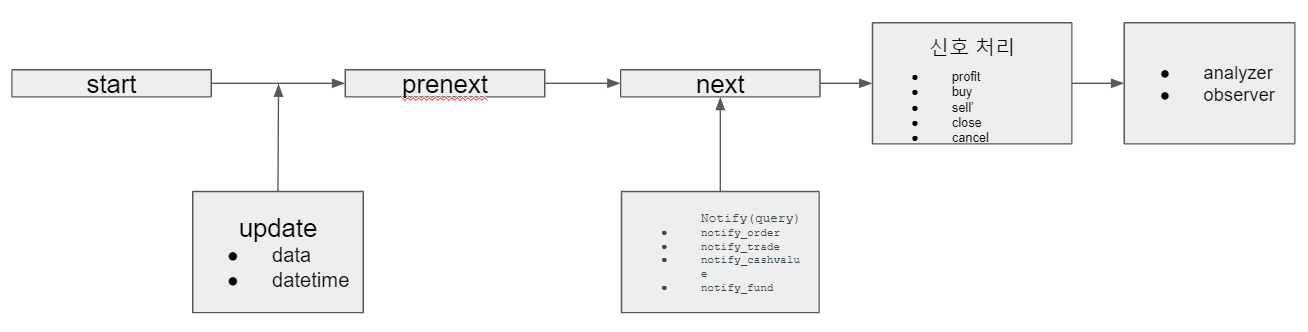

설정과정

- Conception: __init__ - indicator 와 attribute 를 위한 곳

- Birth: start - Cerebro 가 Strategy 에게 시작하라고 말해주는것

- Childhood: prenext - next 가 시작하기전에 next 에 들어갈것들이 맞는지 확인

- Adulthood: next - qbuffer 체계로써 prenext -> next 로 스위칭해 들어가진다.

- Reproduction: None - 재 발급 안함 (optimazing 할때 system 에서는 함)

- Death: stop - Strategy 에게 reset 하게 하거나, 오더내려져 있는것을 걷는 과정

알림설정

- notify_order(order)

- notify_trade(trade)

- notify_cashvalue(cash, value)

- notify_fund(cash, value, fundvalue, shares)

- notify_store(msg, *args, **kwargs)

How to Buy/Sell/Close

- buy(data=None, size=None, price=None, plimit=None, exectype=None, valid=None, tradeid=0, oco=None, trailamount=None, trailpercent=None, parent=None, transmit=True, **kwargs)

- sell(data=None, size=None, price=None, plimit=None, exectype=None, valid=None, tradeid=0, oco=None, trailamount=None, trailpercent=None, parent=None, transmit=True, **kwargs)

- close(data=None, size=None, **kwargs)

Paremeter

- data (default: None) - 어떤 데이터로 거래될지 표기 , self.datas[0] or self.data0 가 default

- size (default: None) - 오더에 사용될 데이터의 사이즈 (None 일시 get_sizer()에서 size 구해옴)

- price (default: None) - 지정가 설정 (라이브에서는 tick size minimum 에 의해 사용 x 권고)

- plimit (default: None) - price 가 지정되었을때 stoplimit 오더 설정

- exectype (default: None)

- Order.Market or None - 시장가 전략, backtesting 때는 next bar 의 opening price 로 거래

- Order.Limit - 지정가에 올때만 거래가능하게 하거나 다른 limit 설정

- Order.Stop - 시장가 전략 이나 지정가 전략에 따른 거래 중지

- Order.StopLimit - pricelimit 에 다를때 오더 Stoplimit

- valid (default: None)

- None: order - 만료 설정 안함, broker 가 자체 설정 하긴 하지만 쓸모없음

- datetime.datetime or datetime.date instance - 주어진 datetime 까지 오더 가능

- Order.DAY or 0 or timedelta() - 데이 트레이딩일때 세션 끝날때까지 유효한 date 설정

- numeric value

- tradeid (default: 0) - 자산에 붙는 index, 알림이 바뀔때 strategy 에게 다시보내진다 (for opt analyze)

- **kwargs - extra parameters 가능

- orderId

- Action - 'B' or 'S'

- Size

- Lmt Price - limit price

- Aux Price - trigger price

- OrderType

- Order.Market : bytes('MKT')

- Order.Limit: bytes('LMT')

- Order.Close: bytes('MOC')

- Order.Stop: bytes('STP')

- rder.StopLimit: bytes('STPLMT')

- Order.StopTrail: bytes('TRAIL')

- Order.StopTrailLimit: bytes('TRAIL LIMIT')

- Tif (Time in Force) - Time In Force: DAY, GTC, IOC, GTD

- 'GTC' - Good til cancelled

- 'GTD' - Good til date

- GoodTillDate

- OCA - 남아있는 오더 취소 및 차단

orderType='LIT', lmtPrice=10.0, auxPrice=9.8Bracket Orders

여러개의 오더(Market, Limit, Close, Stop, StopLimit, StopTrail, StopTrailLimit, OCO)를 한번에 할수 있는 전략으로 main side 와 children side 로 나뉘어진다.

- buy_bracket(data=None, size=None, price=None, plimit=None, exectype=2, valid=None, tradeid=0, trailamount=None, trailpercent=None, oargs={}, stopprice=None, stopexec=3, stopargs={}, limitprice=None, limitexec=2, limitargs={}, **kwargs)

- sell_bracket(data=None, size=None, price=None, plimit=None, exectype=2, valid=None, tradeid=0, trailamount=None, trailpercent=None, oargs={}, stopprice=None, stopexec=3, stopargs={}, limitprice=None, limitexec=2, limitargs={}, **kwargs)

- 설정과정

- 여러개의 오더가 제출되어진다

- main order 를 제외한 order 들은 main side 의 children 이 된다

- children side 는 main side 가 실행되어져야지만 실행되어진다

- children side 는 main side 가 취소되면 같이 취소되어진다

- children side 에 속해있는 side 가 취소될시 모든 children side 는 취소되어진다.

- For more detail <Click>

Rebalance

리밸런싱 목표(target) 의 size,value, percent 로 Portfolio Rebalancing 가능

- order_target_size(data=None, target=0, **kwargs)

- 방법

- If target > pos.size -> (buy) target - pos.size

- If target < pos.size -> (sell) pos.size - target

- target == position.size -> (None)

- 방법

- order_target_value(data=None, target=0.0, price=None, **kwargs)

- 방법

- If no target then (close postion) on data

- If target > value then (buy) on data

- If target < value then (sell) on data

- (None) if no order has been issued

- 방법

- order_target_percent(data=None, target=0.0, **kwargs)

- Example

- target=0.05 and portfolio value is 100

- The value to be reached is 0.05 * 100 = 5

- 5 is passed as the target value to order_target_value

- 방법

- If target > value

- (buy) if pos.size >= 0 (Increase a long position)

- (sell) if pos.size < 0 (Increase a short position)

- If target < value

- (sell) if pos.size >= 0 (Decrease a long position)

- (buy) if pos.size < 0 (Decrease a short position)

- (None) if no order has been issued (target == position.size)

- If target > value

- for more detail <Click>

- Example

Function

- getsizer() - size 제공

- setsizer(sizer) - default sizer 바꾸기

- getsizing(data=None, isbuy=True) - 현재 상황에서의 size 제공

- getposition(data=None, broker=None) - 주어진 broker 에 주어진 data 에서의 현재 position 제공

- getpositionbyname(name=None, broker=None) - name 으로 positon 제공

- getdatanames() - 존재하는 데이터 들의 name 을 리스트로 제공

- getdatabyname(name) - cerebro 환경을 이용하여 주어진 name 제공

Strategy with Signals

- Instead of writing a Strategy class, instantiating Indicators, writing the buy/sell logic …

- The end user add Signals (indicators anyhow) and the rest is done in the background

- Signal 만 넣어주면 알아서 buy, sell 해주는 기능

- 방법 (queried with signal[0])

- > 0 -> long indication

- < 0 -> short indication

- == 0 -> No indication

- 구조

- Main Group

- LONGSHORT: both (long) and (short) indications from this signal are taken

- LONG:

- (long indications) are taken to go long

- (short indications) are taken to close the long position. But:

- If a LONGEXIT (see below) signal is in the system it will be used to exit the long

- If a SHORT signal is available and no LONGEXIT is available , it will be used to close a long before opening a short

- SHORT:

- short indications are taken to go short

- long indications are taken to close the short position. But:

- If a SHORTEXIT (see below) signal is in the system it will be used to exit the short

- If a LONG signal is available and no SHORTEXIT is available , it will be used to close a short before opening a long

- Exit Group:

- LONGEXIT: short indications are taken to exit long positions

- SHORTEXIT: long indications are taken to exit short positions

- Order Issuing

- Orders execution type is Market and validity is None (Good until Canceled)

- Main Group

- Quick Start

- (Long indication) if the close price is above a Simple Moving Average

- (Short indication) if the close price is below a Simple Moving Average

class SMAExitSignal(bt.Indicator):

lines = ('signal',)

params = (('p1', 5), ('p2', 30),)

def __init__(self):

sma1 = bt.indicators.SMA(period=self.p.p1)

sma2 = bt.indicators.SMA(period=self.p.p2)

self.lines.signal = sma1 - sma2- Accumulation and Order Concurrency

- Accumulation: even if already in the market, the signals would produce new orders which would increase the possition in the market

- Concurrency: new orders would be generated without waiting for the execution of other orders

- cerebro.signal_accumulate(True) (or False to re-disable it)

- cerebro.signal_concurrency(True) (or False to re-disable it)

- for more detail <Click>

Reference :

https://www.backtrader.com/docu/strategy/

Strategy - Backtrader

Strategy A Cerebro instance is the pumping heart and controlling brain of backtrader. A Strategy is the same for the platform user. The Strategy’s expressed lifecycle in methods Note A strategy can be interrupted during birth by raising a StrategySkipErr

www.backtrader.com

https://www.backtrader.com/docu/signal_strategy/signal_strategy/

Strategy - Signals - Backtrader

Strategy with Signals Operating backtrader is also possible without having to write a Strategy. Although this is the preferred way, due to the object hierarchy which makes up the machinery, using Signals is also possible. Quick summary: Instead of writing

www.backtrader.com

https://www.backtrader.com/docu/strategy-reference/

Strategy - Reference - Backtrader

Strategies Reference Reference for the built-in strategies MA_CrossOver Alias: This is a long-only strategy which operates on a moving average cross Note: Buy Logic: * No position is open on the data * The `fast` moving averagecrosses over the `slow` strat

www.backtrader.com

https://www.backtrader.com/blog/2019-07-19-rebalancing-conservative/rebalancing-conservative/

Rebalancing - Conservative Formula - Backtrader

Rebalancing with the Conservative Formula The Conservative Formula approach is presented in this paper: The Conservative Formula in Python: Quantitative Investing made Easy It is one many possible rebalancing approaches, but one that is easy to grasp. A su

www.backtrader.com

https://www.backtrader.com/blog/posts/2017-04-01-bracket/bracket/

Bracket Orders - Backtrader

Bracket Orders Release 1.9.37.116 adds bracket orders giving a very broad spectrum of orders which are supported by the backtesting broker (Market, Limit, Close, Stop, StopLimit, StopTrail, StopTrailLimit, OCO) Note This is implemented for backtesting and

www.backtrader.com

https://zhuanlan.zhihu.com/p/338720130

backtrader框架重解读九——高等动物strategy

在backtrader中,最灵活,也是最重要的一个类就是策略类。所以策略类的复杂度比中等动物有上了一个层级。(代码部分较多,如果觉得长,读者只需要读解读部分即可) 架构初思考策略类最重

zhuanlan.zhihu.com

'금융공학 > BackTrader 공부' 카테고리의 다른 글

| BackTrader 5 : Indicators (0) | 2021.12.29 |

|---|---|

| BackTrader 1 : Concepts (0) | 2021.12.24 |

| BackTrader 3 : DataFeed (0) | 2021.12.21 |

| BackTrader 2 : Cerebro (0) | 2021.12.19 |

| BackTrader 0 : Introduce (0) | 2021.12.19 |